Last updated on June 23rd, 2023 at 10:59 am

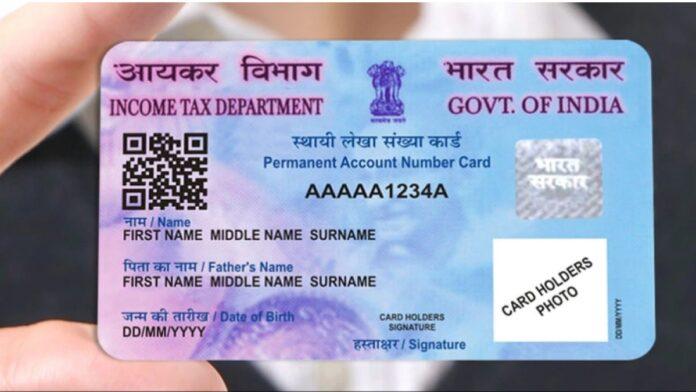

The Income-tax Act, of 1961, enacted by the Government of India, serves as the primary legislation governing the taxation system in the country. Under this Act, every individual or entity that engages in taxable activities is required to have a unique identification number known as the Permanent Account Number (PAN). Additionally, the Aadhaar card, issued by the Unique Identification Authority of India (UIDAI), serves as a crucial identity document for Indian citizens.

Importance of PAN and Aadhaar

Both PAN and Aadhaar play significant roles in various financial and legal transactions. PAN acts as a unique identifier for individuals and entities involved in financial activities, including filing tax returns, conducting high-value transactions, and opening bank accounts. Aadhaar, on the other hand, serves as a proof of identity and residence, ensuring transparency and preventing fraud in government welfare schemes.

Legal Provisions

The Income-tax Act, 1961, was amended in 2019 to include Section 139AA, which made it mandatory for PAN holders to link their PAN with Aadhaar. This amendment aimed to curb tax evasion, ensure better compliance, and establish a robust system for identifying individuals engaged in financial transactions.

Deadline for Linking PAN with Aadhaar

The deadline for linking PAN with Aadhaar is set as 30th June 2023. It is crucial for all PAN holders who are not exempted to adhere to this deadline to avoid potential penalties and legal consequences.

Process of Linking PAN with Aadhaar

The process of linking PAN with Aadhaar is relatively straightforward. The government has provided multiple avenues to facilitate the linking process. Individuals can link their PAN with Aadhaar through online portals, SMS, or offline modes by visiting designated centers. Detailed instructions and guidelines are available on the official websites of the Income Tax Department and UIDAI.

Consequences of Non-Compliance

Non-compliance with the requirement to link PAN with Aadhaar by the stipulated deadline can have several consequences. Individuals who fail to link their PAN with Aadhaar may face penalties, including the invalidation of their PAN. Moreover, they may encounter difficulties in conducting financial transactions, such as filing tax returns, opening new bank accounts, or even availing of government services.

Benefits of Linking PAN with Aadhaar

Linking PAN with Aadhaar offers several benefits for both individuals and the government. Some of the key advantages include:

- Seamless Tax Filing: Linking PAN with Aadhaar simplifies the process of filing income tax returns, making it more convenient and efficient for individuals.

- Enhanced Compliance: The linkage ensures better compliance and transparency in financial transactions, discouraging tax evasion and promoting a fair taxation system.

- Streamlined Government Welfare Schemes: Aadhaar-linked PAN facilitates the efficient delivery of government welfare schemes, ensuring that benefits reach the intended beneficiaries promptly.