Introduction

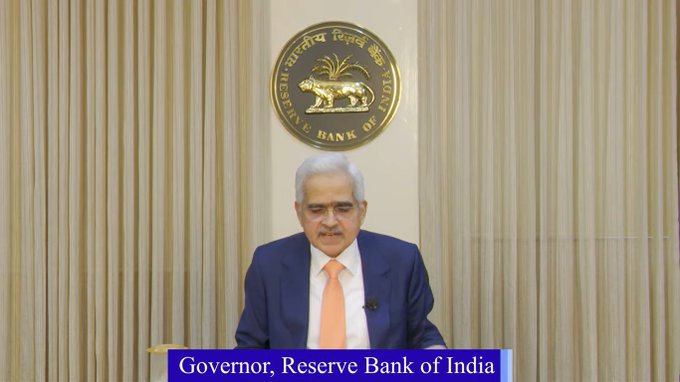

In a highly anticipated press conference, Shri Shaktikanta Das, the Governor of the Reserve Bank of India (RBI), provided crucial insights into the post-monetary policy decisions and shared the central bank’s outlook on the economy. With the goal of maintaining stability while fostering growth, the RBI’s measures seek to address the challenges and capitalize on the opportunities in the current economic landscape.

Addressing Inflationary Pressures

Governor Das began by acknowledging the persistent inflationary pressures faced by the Indian economy. Recognizing the impact of rising commodity prices, supply chain disruptions, and the recovery from the pandemic-induced slowdown, the RBI emphasized the need for calibrated policy actions. The central bank reaffirmed its commitment to keeping inflation within the target range, leveraging its monetary tools judiciously.

Monetary Policy Decisions

Shri Das outlined the key decisions taken by the Monetary Policy Committee (MPC) in the recent review. The RBI decided to maintain the status quo on the policy repo rate, keeping it unchanged at its current level. This decision reflects the central bank’s prudent approach to balancing the objectives of containing inflation and supporting growth.

Additionally, the RBI announced measures to enhance liquidity support and strengthen the banking system. These measures include adjustments to the liquidity management framework, refinancing facilities for small finance banks, and targeted long-term repo operations to provide liquidity support to specific sectors.

Focus on Financial Inclusion and Digital Payments

The RBI Governor emphasized the importance of financial inclusion and the role of digital payments in driving economic growth. The central bank is actively promoting initiatives that encourage wider access to financial services, such as bank accounts, credit, and insurance, particularly in rural and underserved areas. Furthermore, the RBI is working towards creating an enabling environment for digital payments, aiming to facilitate secure, seamless, and affordable transactions for all stakeholders.

Economic Outlook and Projections

Shaktikanta Das provided insights into the RBI’s economic outlook, taking into account the evolving domestic and global factors. While the second wave of the pandemic posed challenges to the economy, the RBI expects a gradual recovery in the coming quarters. The central bank emphasized the importance of vaccination coverage, effective implementation of structural reforms, and supportive fiscal and monetary measures in driving sustainable growth.

Governor Das also highlighted the need to closely monitor global developments, particularly regarding trade dynamics, geopolitical risks, and commodity price movements, as these factors can influence the Indian economy’s trajectory.

Conclusion

Shri Shaktikanta Das’s post-monetary policy press conference provided valuable insights into the RBI’s approach to maintaining stability, addressing inflationary pressures, and fostering economic growth. The central bank’s decision to maintain the policy repo rate, coupled with liquidity-enhancing measures, reflects a balanced strategy aimed at supporting recovery while guarding against inflation risks.