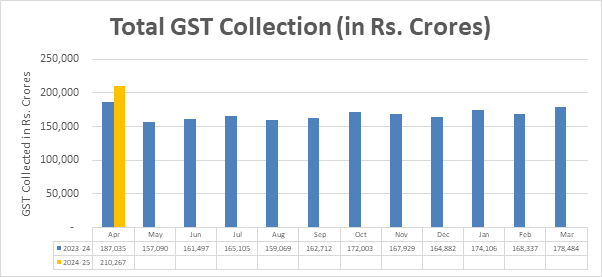

In a remarkable display of economic resilience, the Gross Goods and Services Tax (GST) collections in April 2024 soared to an all-time high of ₹2.10 lakh crore. This achievement represents a noteworthy 12.4% year-on-year growth, showcasing the buoyancy and strength of India’s taxation system.

The surge in GST collections is attributed to a substantial increase in both domestic transactions, up by 13.4%, and imports, which rose by 8.3%. After accounting for refunds, the net GST revenue for April 2024 stands impressively at ₹1.92 lakh crore, indicating a remarkable 17.1% growth compared to the same period last year.

A breakdown of the April 2024 collections reveals positive performance across various components:

- Central Goods & Services Tax (CGST) amounted to ₹43,846 crore.

- State Goods and Services Tax (SGST) totaled ₹53,538 crore.

- Integrated Goods and Services Tax (IGST) reached ₹99,623 crore, with ₹37,826 crore collected on imported goods.

- Cess collections amounted to ₹13,260 crore, including ₹1,008 crore collected on imported goods.

Additionally, during April 2024, the central government allocated ₹50,307 crore to CGST and ₹41,600 crore to SGST from the IGST pool. This distribution results in total revenues of ₹94,153 crore for CGST and ₹95,138 crore for SGST for April 2024, post the customary settlement process.

The robust GST collections in April 2024 reflect a resilient economy and bolstered consumer confidence, underlining India’s steady progress towards economic recovery and growth.

.jpg)